UK Pension Transfer

Is it Possible to Transfer a UK Pension to Ireland?

Yes, it is possible to transfer a previous pension holding from the UK to Ireland. However, it may not be advisable. Caution needs to be the order of the day when considering this process. The receiving Irish pension arrangement must be HMRC (Her Majesty’s Revenue and Customs) approved QROPS (Qualifying Residential Overseas Pension Scheme) which facilitates Pension transfers from the UK to Ireland. You can transfer most private-sector pensions.

The QROPS rules 2017 have altered the QROPS landscape completely. In brief, it placed significant additional rules and penalties on receiving pension providers. Such was the extent of these new rules. Many Irish Approved QROPS providers decided to deregister their QROPS Approval with HMRC.

Is it Possible to Transfer a UK Pension to Ireland?

- We would advise you to outline to us what you are hoping to achieve in potentially transferring your UK pension to Ireland as we would need to establish if transferring your fund is the right decision for you. We meet with you and look at your pension position here.

- On receipt of the above information a further meeting is arranged to discuss options.

- Client to consider options above and pros and cons of leaving funds and transferring, as previous mentioned it may not be advisable.

- If client decides to transfer we can assist in drafting relevant paperwork and transfer of funds to QROPS.

Why Transfer Pension UK Pension to Ireland?

Some people retiring in Ireland find it convenient to draw benefits in Euro and find it more convenient deal with a pension provider in Ireland

QROPS can accept transfers from the UK without any tax implications

Pension transfers to QROPS won’t impact on the €2M Standard Fund Threshold (SFT)

For inheritance tax planning if the beneficiaries of your pension aren’t living in the UK leaving it there may be more complicated.

QROPS – A simple guide

You can take retirement benefits from a QROPS with no UK tax implications where:

The individual is age 55 or over, and

Retirement benefits are paid in line with UK rules as an ‘authorised payment’ i.e. 25% of the fund as a retirement lump sum with the residual fund taken as an annuity and/or an ARF

And

For UK transfers received before 6 April 2017: Retirement benefits can be drawn down once an individual has ceased being a UK tax resident for at least 5 UK tax years (and is age 55 or over), or

For transfers received on or after 6 April 2017: Retirement benefits can be drawn down once an individual has ceased being a UK tax resident for at least 10 UK tax years (and is age 55 or over)

If retirement benefits are taken without meeting the above requirements then the payment may be viewed as an ‘unauthorised’ payment with potential tax charges/penalties of up to 55% (40% unauthorised payments charge and possibly also a 15% unauthorised payments surcharge) applying. Alternatively, the retirement benefits may be taxed in both jurisdictions.

What way can I draw my pension benefits if I transfer to Ireland?

You will draw your pension benefits under the Irish System see drawing pension benefits

I have paid PRSI contributions in Ireland and Paid National Insurance contributions in the UK

Depending on the number of social insurance contributions you have paid in The UK and Ireland you may be entitled to a portion of the state pension from both jurisdictions. We advise clients that have made social insurance contributions in both jurisdictions to contact the Department of Social Protection (DSP) here in Ireland and the Department of Work and Pensions (DWP) in the UK. To get a profile of their contributions throughout their working life and what estimate what benefit this will provide them with at retirement age.

BREXIT Impacts

The UK will leave the European Union on 31st January 2020, with the Withdrawal Agreement having been agreed and ratified by both the UK and the European Union. A transition period will follow lasting until at least 31st December 2020. During this time all the existing EU social security regulations will continue to apply to the UK. This means there is no change to the existing reciprocal social security arrangements between Ireland and the UK.

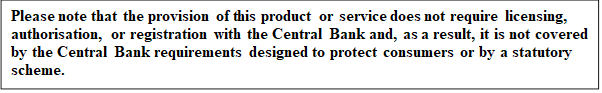

Important Information

This area of transferring UK pensions to Ireland is very complex, Rules and Laws change are liable to change and change quickly. Therefore it is imperative anyone considering this action should seek all information and facts relevant to their individual circumstances in advance of making a decision. The information provided above is generic and is not to be relied upon in making a decision to transfer benefits

Request Consultation Today

Contact one of our team today and request a consultation for one of the services.